The following appeared in the Financial Times today:

As Expected: Treasury Sees Red At Huhne’s Green Bank

Monday, 31 January 2011 12:35 Elizabeth Rigby, Financial Times

Chris Huhne is at loggerheads with the Treasury over the size and scope of the green investment bank, as officials seek to thwart his attempts to ensure it operates as a fully fledged bank.

The Treasury has already earmarked £1bn for the bank, to be spent on green infrastructure projects such as renewable energy. It has also privately confirmed that more than £1bn of funds from asset sales will also be made available, according to two ministerial aides. But in return for the additional funds, officials are trying to prevent the energy secretary and Vince Cable, the business secretary, from establishing it as a bank. The bank is one of the flagship green initiatives of the coalition.

A commission on how the bank should operate – led by Bob Wigley, a former European head of Merrill Lynch – has recommended it should have powers to raise finance from the private sector. But the Treasury is concerned the bank will increase national debt and would prefer it to act simply as a fund, dispensing grants and loans.

“The Treasury is completely against the idea of a proper bank because they can’t see where it would go on the government’s balance sheet,” said one person familiar with the talks. “Huhne is determined to get a bank and Cable is acting as the arbiter.”

Mr Huhne believes the bank is central to efforts to build Britain’s green infrastructure and low carbon economy in the coming decades. The energy sector needs to invest at least £200bn over the next 10 years to meet official targets for developing renewable energy and cutting carbon dioxide emissions.

The government is due to outline plans for the bank this spring but is struggling to meet the deadline.

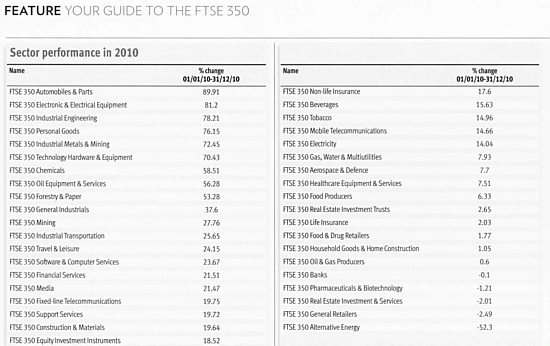

I wonder if anyone at the treasury, let alone at Chris Huhne’s Department of Energy and Climate Change, saw this chart that someone kindly pointed out to me in the Investors Chronicle:

Note the juxtaposition of Automobiles and Parts (+89.91%) and Alternative Energy (-52.3%) at the beginning and end of the listing.

If this reflects the level of market confidence, post Copenhagen and Cancún, in the coalition’s so-called Green Revolution, then God help the green bank. Investment in Alternative Energy looks as though it holds about as much allure as subprime mortgages, and it seems that the coalition has learned nothing from the banking crisis. The value of assets are determined by supply and demand: politically correct optimism is not an entry that any accountant would attach a value to on a balance sheet.

I seem to remember the Department of Energy and Climate Change estimating the cost of complying with the Climate Act and decarbonising the UK Economy £480bn (Yep, bn, I haven’t checked the figure but that doesn’t matter,it’s obviously a very, very large one.)

So far as I am aware, the Green Investment Bank, with liabilities underwritten by the government is the only idea that the coalition has for raising the kind of funds needed for investment in alternative technologies on a scale that would meet the targets.

Without the GIB, decarbonisation as a policy is stuffed, and that was the point of this post. With the GIB, the government risks floating a new nationalised bank that will be investing in a very high risk market that othe investors are shunning and the private sector will not touch without the support of public funds. Without the GIB, the costs would have to be passed on to the public directly, which is hardly likely to go unnoticed.

The cheapest way to decarbonise the UK economy is to copy the French and go nuclear.

They have about half the CO2 emissions and with a similar, (or better ?), standard of living so there is no need to despair just yet.

PeterM #27 You know its quite amazing that so many people agree with you about the cheapest way of de-carbonising the UK economy, yet it is the one area that the coalitions is at pains to point out they will not subsidise. This is why de-carbonisation will not happen in the short term.

As for the std of living being better in France….! My brother and Sister both live their and their complaints about everyday life are similar to what you here from the average Brit. Levels of taxation being the biggest complaint.

TonyN

Trading in Carbon has been suspended in the EU, but this fact is getting amazingly little publicity. Amazing how our press seems to avoid contentious issues that highlight the real incompetence of the EU.

Basically through fraud many certificates have been stolen and then resold. Now those that have the certificates don’t know if they are the genuine owners or the subjects of fraud and likely to have their certificates confiscated. So there is a move afoot to have the EU publish who owns what, a move that is being resisted. Talk about an open and honest market!! I think the EU is trying to ensure they are not held libel for the losses.

There can be little confidence in any aspect of the green revolution at present with fraud seemingly at every level. There has to be a lesson here on how to conduct matters of government, but as with the banking crisis there is one group failing to admit their culpability in the whole process, our political class. Until they do progress will not be made.

This is just another symptom of what happens when governments try to push a highly developed society in a direction that is based of dogma rather than substance.

PeterG and PeterM

If you are concerned about “carbon footprint”, nuclear is certainly the way to go, as you’ve both remarked.

IMHO the best measure of a national economy’s ability to generate wealth for its citizens with the lowest “carbon footprint” is the annual GDP per ton of CO2 generated.

Attached is an up-dated table showing the “carbon efficiencies” of various major economies:

http://farm6.static.flickr.com/5291/5467159842_41256896ed_b.jpg

As you can see, France (with around 80% nuclear power) is pretty much on top of this list, with the UK, Germany and Japan close behind. (Switzerland is actually even higher than France, with very little fossil-fuel based power, but since it is so small I did not show it separately.)

The USA, Canada and Australia are a bit lower, probably primarily due to the lower population densities and longer distances.

Russia, China and India are still pretty low, but both India and China have increased this efficiency considerably over the past few years (as GDP growth has outpaced growth in CO2 emissions).

Max

PS TonyN: does this belong on the NS thread?

On the subject of energy, here’s a good article in The Register from last Friday re the Commons Energy and Climate Change Select Sub-Committee taking a look at shale gas this coming Tuesday (1st March.)

From The Register:

Alex

To the list of disruptions, you can add massive political disruption. Here in France, shale gas has been discovered under the Larzac plateau, a sacred site to ecologists, since Mitterand bowed to public pressure and removed French nuclear missiles, and handed the land over to green co-operatives. This is where eco-megastar José Bové raises sheep to make Roquefort. (Actually, someone does it for him, since he’s rather busy flying round the world saving it from captalism).

Despite the fact that the government has halted exploration on the Larzac Plateau, 20,000 protesters turned out last weekend in a tiny village to warn them off.

The socialists are almost sure to beat Sarkozy in next year’s election, but they need the support of the Greens. There are serious environmental questions over shale gas exploration (pollution of the water table etc) but they won’t get discussed rationally in France, in what is sure to be a massive political battle if any government were so foolish as to try and make the country self-sufficient in energy.

PeterGeany

I’ve just read your #12. Your interesting analysis of the sources of the banking crisis is largely echoed here in France by ATTAC, a group of leftwing economists (numerate refugees from the evaporation of the Communist Party). Unfortunately, their analysis is rather spoilt by their recommendation that governments should take back control of the economy … in order to invest in the green future.

TonyN #15

While I wouldn’t deny many of your criticisms of pre-Thatcher Britain, I disagree most strongly that her policy of privatisation helped to resolve Britain’s chronic low productivity, which was just as bad in private industry as in the public sector. Closing unprofitable steel mills and encouraging profitable management consultancies certainly increased productivity on paper, and made Britain a rather different country (and one I’m happy to be out of, in some ways).

The British working class (more numerous and more unionised than their continental counterparts) have traditionally preferred lower growth and productivity, (and an easier life) to the high unemployment (and also stress, as measured by suicide and alcoholism) found in France. Grotesque working practices (e.g. in printing industry) and a small number of highly publicised daft policies in red town halls led Thatcher to declare war on the working class, a war which she declared won with the defeat of the miners (and the loss of 30% of Britain’s industry).

But you don’t change the anthropological make-up of a country overnight. The British worker and the rentier capitalist alike continue to prefer a quiet life with a minimum of change (i.e. efficiency).

On a recent visit to London I sat in a fast food emporium watching a multicoloured group of middle-aged ladies leaning on their mops, chatting, and occasionally wiping a table – British multicultural low productivity in action. In France these old dears would have no chance of a job – and their offspring would be out in the streets torching cars.

geoffchambers, #33:

I get the impression that you have skipped from the Thatcher years to the present day without pausing at the age of Blair and Cool Britannia, with easy living on low interest rates and bountiful credit. Since when were coolness and debt compatible with competitiveness and productivity? It is the attitudes that were promoted to keep the New Labour project on course that have formed the public state of mind today, not the Thatcher years. And as you so rightly say,”you don’t change the anthropological make-up of a country overnight”.

In any case I do not think that the economic fantasy that underpins the Green Revolution would have received a moment’s serious consideration in the UK during the 1980s. That may have been a decade of economic brutality, but at least the issues were well defined and understood in the cold light of reality; for both sides.

I was looking at a report from Bloomberg today (usually fairly reliable) suggesting that the feed in tariff on solar generation will lead to subsidy of up to 12 times the market rate unless the government act quickly. And if they do, then investors are likely to be very reluctant to back this, or any other form of renewable energy, which requires them to have rely on the good faith of politicians in order to be profitable.

TonyN #34

You’re right, I overlooked the Blair years – and can you blame me?

I didn’t intend to start a party political debate, but rather to question the value of Thatcher’s assault on low productivity. It’s a feature of British politics over the past fifty years now that it has been defined by the worries of a ruling élite, rather than by the demands of electors. No voter ever complained about falling productivity, just as no voter ever complained about rising carbon emissions. When politicians and their establishment allies define policy by abstract concerns (often involving misleading comparisons with the performance of our neighbours) they falsify the debate, confuse the electors, and lead to the current state of what Ben Pile at Climate Resistance calls a political vacuum, in which all kinds of strange movements may flourish.

You’re right that the Thatcher years were characterised by a clearer definition of political reality, a reality which was muddled first by Blair and now by Cameron. Pressure friom UKIP and libertarian critics like Delingpole may have an effect on the Conservative party, forcing them to rethink their current centrist muddle. What force is there exerting pressure on the Labour Party, other than the Greens?

geoffchambers, my analysis is an amalgamation of lots of little bits that I pick up here and there and put together myself. If others come to the same conclusion that is no surprise as an honest look draws one to that conclusion. Your views on the 80’s are interesting. I still remember my first day of work in the UK in Dec 79. I turned up at 1:00pm to find no one in the office! They were all at the pub, and stayed until it closed at 3:00. This doesn’t happen much today, and everyone is better off for it. I always feel felt better when the pace of work is fast and the day flies by and then you can play hard at the appropriate time.

You are correct about the lack of productivity in the 70’s in the private sector, but that was due to political interference that discouraged good management practises. This has nothing to do with the pace of work for this is not what makes a happy workforce or increases productivity. That requires sorting out the hygiene factors as Maslow called them (this should be a given in any serious organisation but is overlooked to a lamentable level. They are also the easiest to fix.) Once these factors have been sorted then working practises can be developed to increase productivity. Improving productivity does not equal working harder, which is a mistake the Left always makes. Improved productivity ALWAYS results from working smarter and that only ever happens when the workforce is fully engaged. There are NEVER any exceptions to this rule, and is generally why the traditional unions fell out of favour with smart workforces around the world.

Perhaps the only organisations we have today that understand these issues correctly are manufacturers, or more precisely the successful ones. Of course there are others firms from other sectors that get it right, but manufacturers live and die by the factory gate, and so know exactly what they need to do. However it is no surprise that all of the wind turbine manufacturers are slowly going bust. This is because their factory gate prices have been distorted by virtual reality, and so they have worked to unrealistic figures where there is no real demand, only a government subsidy driven by fanciful requirements. Much like the defence industry really. And as TonyN has pointed out above we have reached the point where real money is needed to move the green agenda on, and that money will not be forthcoming as it relies totally on subsidy, rather than need, and relies on political good will and guarantee. A political guarantee as we all know is worthless, especially when it does not have public support.

Geoff I don’t recognise your view of Thatcher’s Britain, and I was in my 20’s all through it, but I did recognise a bunch of dead beat useless lazy and demoralised people when I first arrived that suddenly turned into a happy enthusiastic bunch of hardworking people by the end of the 80’. That is not to diminish the upheaval many people went through, but it took a leader of conviction and courage to achieve it. It is an old adage that everyone’s strengths are also their weaknesses, and Thatcher was no exception and the poll Tax was the right idea with the wrong application. She too found limits when it came to changing the attitude to the public sector.

Our current political class collectively cannot gather the conviction or courage of Thatcher, but I would not necessarily say a reincarnation is what Britain needs. What we need is a leader for today’s issues, a leader who can cut through the technical issues of today’s world and is able to build a team to run the country to its best advantage, rather than run it to please all the various pressure groups. Unfortunately I don’t see one on the horizon.

Britain once led the world in technology that morphed into high technology. Britain still leads in many areas although the world is much more of a global enterprise, where our people are now very good at providing services and hence the resultant increase in service industries. This has come at the expense unfortunately in manufacturing that many people lament. However we can hold our own if we so chose, as exemplified by JCB and Rolls Royce aero engines. Both of these companies are well managed compared to most. Look at all the formula one teams that are based here. And look what happens when Japanese car manufacturers set up here. It’s all down to management. Contrast this with the nebulous green industries. What are these industries trying to provide us with that is useful??? Bloody nothing. And at the same time these industries are being championed, those same nincompoops are damaging the very same successful manufacturing industries where we lead the world such as Roll Royce with their continuous barrage about CO2 being a pollutant. You have to marvel at the stupidity of it all. Add to this the huge costs being added to energy that hampers manufacturing and you just have to wonder if we have stumbled upon some new species of animal, where the brain is contracting.

Britain’s attempts at a high-speed rail are another piece of green theatre. If the rail were in place today it would be of use. However it is based on old technology, technology that is energy intensive and intensive of infrastructure costs. It will compete for revenue (passengers) with current rail, air and buses. It won’t remove cars from the road as getting to and from the stations will be both costly and time-consuming. It may be attractive to certain commuters working in London, who will be able to offset the horrendous costs onto their clients, but of no use to ordinary commuters. It will not replace air travel which is already cheaper and faster, so what is it for??? Where is the pressing need???

Peter Geany

I recognise features of your work experience. Judging by Ricky Gervais’s “The Office” the same mentality is still alive and well, so Thatcher’s union bashing, accompanied by the destruction of a third of British industry, can hardly claim to have resolved the problem.

I agree about high speed rail as “green theatre”. It’s a good example of what I meant by “misleading comparisons with the performance of our neighbours”. “France has got it, so we must have it” seems to be the rationale, forgetting that France has twice the surface area of Britain, and our population distribution is such that three-quarters of the population of England are within a three hour train journey of London already. (I just made those figures up, but I bet they’re not far off).

The rationale for being “at the forefront” of green technology is even more bizarre. If Huhne and co really believe that solar and wind technology are going to become competitive, why not let Slovakia and Germany take the strain of massive subsidies, until the technology is perfected and can be installed economically? The Japanese and Chinese companies which make these gadgets will still install factories in Wales if we make it worth their while. If some British boffin has a bright idea, he can make massive profits on the back of the Slovakian taxpayer just as easily as on ours.

The Bloomberg article TonyN references above says it all. It’s not about financing British boffins; it’s about convincing pension fund managers that the government won’t change their minds every minute. They’ve already lost it, but the politico-media consensus means it may be a long time before politicians and voters realise what’s happening.

This BBC story seems to have come at a very convenient moment:

http://www.bbc.co.uk/news/uk-scotland-12597097

Three things I noticed:

If each green job displaces 3.7 other jobs, am I right in criticising the green revolution for compromising productivity?

Note the use of tenses; the report from Verso Economics seems to deal with what has happened, the Scottish Government’s defence speaks entirely of what wiil happen.

The Scottish Government, as quoted by the BBC, makes no response to the main findings of Verso, but indulges in plenty of irritable and futile arm waving.

I see those with shrinking brains have just given the go-ahead for electrification of the great west line. What is not clear is how they are going to run 2 different types of trains on the network as the routes they have chosen to highlight as being electrified are only but a fraction of the actual network. A typical half thought out green scheme that I presume will run on the power produced by covering Wales in wind turbines. Currently I can think of a thousand better ways to spend our money.

I make a prediction this scheme will die on the vine as economic conditions worsen. I travel this line everyday to work and just can not believe the bull coming out about improved journey times. The trains are already travelling at 125 mph but are more often than not delayed by signalling or not having a platform available at the next station. Electrification won’t resolve those issues.

I’ve just come across this quote by Dick Cheney:

“If there’s a 1% chance that Pakistani scientists are helping al-Qaeda build or develop a nuclear weapon, we have to treat it as a certainty in terms of our response. It’s not about our analysis … It’s about our response.”

So why is this principle not applied to AGW which, even you guys have to admit, is more than a 1% risk?

TonyN,

Sorry I posted #40 here by mistake. Delete it or shift it to the NS thread if you like.