The following appeared in the Financial Times today:

As Expected: Treasury Sees Red At Huhne’s Green Bank

Monday, 31 January 2011 12:35 Elizabeth Rigby, Financial Times

Chris Huhne is at loggerheads with the Treasury over the size and scope of the green investment bank, as officials seek to thwart his attempts to ensure it operates as a fully fledged bank.

The Treasury has already earmarked £1bn for the bank, to be spent on green infrastructure projects such as renewable energy. It has also privately confirmed that more than £1bn of funds from asset sales will also be made available, according to two ministerial aides. But in return for the additional funds, officials are trying to prevent the energy secretary and Vince Cable, the business secretary, from establishing it as a bank. The bank is one of the flagship green initiatives of the coalition.

A commission on how the bank should operate – led by Bob Wigley, a former European head of Merrill Lynch – has recommended it should have powers to raise finance from the private sector. But the Treasury is concerned the bank will increase national debt and would prefer it to act simply as a fund, dispensing grants and loans.

“The Treasury is completely against the idea of a proper bank because they can’t see where it would go on the government’s balance sheet,” said one person familiar with the talks. “Huhne is determined to get a bank and Cable is acting as the arbiter.”

Mr Huhne believes the bank is central to efforts to build Britain’s green infrastructure and low carbon economy in the coming decades. The energy sector needs to invest at least £200bn over the next 10 years to meet official targets for developing renewable energy and cutting carbon dioxide emissions.

The government is due to outline plans for the bank this spring but is struggling to meet the deadline.

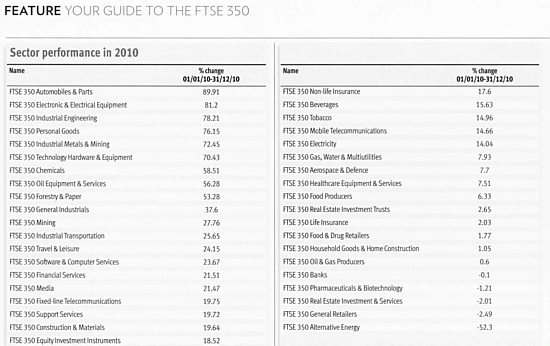

I wonder if anyone at the treasury, let alone at Chris Huhne’s Department of Energy and Climate Change, saw this chart that someone kindly pointed out to me in the Investors Chronicle:

Note the juxtaposition of Automobiles and Parts (+89.91%) and Alternative Energy (-52.3%) at the beginning and end of the listing.

If this reflects the level of market confidence, post Copenhagen and Cancún, in the coalition’s so-called Green Revolution, then God help the green bank. Investment in Alternative Energy looks as though it holds about as much allure as subprime mortgages, and it seems that the coalition has learned nothing from the banking crisis. The value of assets are determined by supply and demand: politically correct optimism is not an entry that any accountant would attach a value to on a balance sheet.

There’s an article here about how they might resolve the problem

http://www.guardian.co.uk/environment/2011/feb/01/oliver-letwin-green-investment-bank

Half a trillion of unsupported debt off balance sheet, and they hope no-one will notice. Yes, that was “half a trillion” as in 25% of GNP. The Guardian had to correct the article, since at the first stab they wrote “million” instead of “billion”.

A micro-example of how “green energy” financing will work out in practice: I heard about a guy here who’s taking advantage of French schemes to subsidise renewables by setting up a solar panel company with generous government finance. Naturally, he’s a Green, whose work experience is in an NGO helping people in difficulty. So naturally, his first act is to hire the kind of people he’s used to working with. So your solar panels are being installed by a crack team of ex-addicts, alcoholics, handicapped people etc. It would make a great subject for a comedy series. I wonder if the BBC would be interested?

TonyN

I use mozilla firefox and linux on my netbook and can see the comments section.

On my computer with windows I can’t. This is why I haven’t commented on this thread. It has happened also with several other threads in the past.

The sad truth is that renewables are unfortunately extremely inefficient and consequently highly expensive. It is sheer dogma preventing the building of desperately needed grown up power stations.

Once our energy needs are secured by the building of nuclear plants and ideally coal ones (as we have the fuel in abundance and the technology is well known) we can start to follow the green energy pipe dreams.

Bearing in mind all the hype I am surprised by the figures in the chart shown above

Tonyb

[TonyN: I’d be very interested to hear from anyone else who has encountered the same problem with seeing the comments, and if so on which threads]

TonyN, I’m using WinXP at home – Google Chrome (default) and Firefox are okay but Internet Explorer 7 cannot see the comments to this post, and I think this was the case with some earlier threads, as Tonyb has said. Not sure why – could it be the graphic?

Many thanks Alex.

I have another report of problems in IE7 and will try to get to the bottom of the problem next week. It seems that ‘bad’ HTML may be the cause although this could be because I am using a very out of date WordPress theme (Tiga)rather than carelessness or incompetence. The MS browsers always were a bit fussy.

tonyN

People can’t tell you that they can’t see the comments if they can’t see the comments…

It happens on Windows XP and 7

I can’t tell you on which other threads it happened as I lost interest when I couldn’t see them-it’s certainly been 4 or 5

Tonyb

It’s certainly looks as though the green lobby have their work cut out for them. In the Independent, recently:

But these financial institutions are “riddled with climate change sceptics”, according to Aviva’s Paul Abberley, as reported in the Guardian:

Investment professionals more interested in returns for their investors than saving the planet? I’m shocked!

Alex:

The figures in your first quote are truly eye-watering, but they don’t sound incredible to me. Will anyone other than governments, who are generally speaking skint, make that kind of investment in an ideal?

I sometimes wonder if the end of the AGW saga will be brought about not by scandals in climate science, rethinks by politicians or a change in the weather, but by the money men bleeding the subsidy conduit dry and moving on.

TonyN, now the Committee on Climate Change is under threat and the Carbon Trust is losing much of its funding, as per the Guardian here and here. Not quite a St Valentine’s Day massacre of the quangos, but close.

It could well be the case, as you say, and as Peter Geany I think has also said, that money might be key to the AGW saga (or this chapter of it, anyway.) If the low carbon society is unaffordable, it’s not going to happen, realistically.

Alex Cull, #8:

There certainly seem to be some very interesting undercurrents although it is still difficult to see how this will translate into a full scale retreat from policies in which both sides of the coalition have invested so much political capital. Perhaps full scale fuel protests with riots in Whitehall, motorways blocked and supermarkets emptying will be the final straw. I understand that we now have the most expensive fuel in Europe.

Did you see Peter G’s link to how the forever calm and pragmatic Dutch are now viewing things?

http://www.theregister.co.uk/2011/02/10/holland_energy_switch/

If they really are prepared to defy the EU on this, then will some of the East European countries follow?

Alex

In contrast to the Guardian articles to which you link, this one

http://www.guardian.co.uk/environment/2011/feb/14/carbon-trust-energy-saving-cuts

suggests that the qangoes were bloated and their cuts may be no bad thing.

This one, which is headlined Hildegaard but labelled Huhne

http://www.guardian.co.uk/environment/2011/feb/14/chris-huhne-eu-emissions-targets

contains the following bizarre quote from the climate change secretary:

Does he always talk like that?

TonyN, interesting re the Netherlands, although the story doesn’t seem to have filtered through into the media here yet. Definitely a development to keep an eye on.

Geoff, re Huhne, I’m afraid he does! Mr Huhne appears to live on a fascinating planet, albeit very different to this one we’re familiar with.

TonyN I had to install Google chrome to see this post and its comments. This happened once before and I just put it down to my machines, but I have tried all versions of IE, 6 and 8 at work, and 7 and the new 9 at home and cannot see this post properly with any of them.

Anyway, to answer your question; I would say most definitely yes. I know none of us reading and contributing to your blog would be silly enough to put any personal money into alternative energy projects, but there are still many many advertisements for investments in “green energy” and just as worrying and also damaging there are a lot of “energy consultants” spreading doom and gloom about our existing energy sources especially oil. This indicates that vested interests are hard at work ensuring their own wellbeing and not showing the slightest concern at all in either their countries interests or the individual’s interests. And the information often flies in face of on the ground reality.

We have a parallels happening in energy similar to those that have just occurred with Banking. At the root cause of both are weak political systems (lax democratic accountability) and poor regulation.

Let me explain. In the wake of the banking crisis which we are miles from resolving, we still have not had those responsible for the mess put their hands up. Instead we have had much gnashing of teeth about bonuses and poor lending practises. Yes these played their part in the orgy of lending towards the end of the crisis but did not cause it and even if bonuses had been half what they were would not have made the slightest difference. What happened was politically the US, and then others (and critically this goes back to Clinton and Blair alliance) allowed banks to borrow and lend without proper capital ratios and without being forced to accept full responsibility for their actions. A small number of bankers for their part promised eternal riches based on computer modelling. Uummm sound familiar?

At first only some banks were reckless, (they were safe whilst only they played) whilst others stood back aghast at what they were doing. However these banks started to make vast sums of money which allowed them to expand and critically adversely effect the share value of those that didn’t participate. Those banks that did not participate got swallowed up. Where were our regulators when this happened? Asleep as usual! Now whilst only 20 to 25% of the banking community played this deadly game all was well. The majority paid for the minority. But as soon as everyone jumped in the money dried up and suddenly confidence deserted the market. What was not apparent to many was that Bankers were forced to adopt poor practices due to political interference in the markets. Ireland is a classic case of this where they were forced to accept low interest rates of the Euro that effectively gave the country a negative interest rate. When the history of this event is written our Politians will not come out with enhanced reputations.

In the wake of the crisis Billions in taxpayers money has been spent to pay for this mess. The British public at large still think it was the banker fault, and whilst this persists were will never fix the root cause. My brief explanation is over simplified but I hope the gist of what happened is in there.

Now to energy; once more our politicians are interfering, not to push better or more efficient technology but to pushing alternate or inefficient technology. Our political leaders for all their plethora of advisers, are playing out an agenda, and ignoring the lessons of the last 250 years. That they will fail is beyond question. We have the Banking example above where an experiment to make us all rich came crashing down. And ironically it is the banking crisis and its botched aftermath that is the catalyst for the crumbling of the green agenda. The people of Britain are not going to agree to massive green investment when cherished services are being cut to pay our way. It’s not the science that is causing the shift in public opinion; it is money, the only thing that ever matters. When we all feel well off we switch off and politicians can almost get away with anything, just as they did from the mid-90s until 2007.

The last Government in a fit of political vandalism committed to a large increase in expenditure without costing it out. This has resulted in additional borrowing and costs to you and me again without any accountability. Inflation has started to rear its ugly head and some of this inflation is self-inflicted. This is very apparent in the energy sector where we see gas on the world market at half the price it was a year ago yet we are paying more. At long last we see the regulator looking into this, but we have forked tongued Politians who want the energy generators to deliver a 20% reduction in CO2 emissions and encouraging these self-same generators to extract a levy on every house hold to pay for it and then pretending they are not offering subsidies.

In Europe we see many instances of subsidies being removed from solar, and wind. And again it’s the same thing we saw in banking. If just 5 % of households took up the solar option and made use of the feed in tariff then no one would notice. The many paying for the few. However a soon as everyone realises this is an invitation to print money the stupidity of the scheme becomes apparent and its cost are unsustainable. Wind is a disaster and there was an interesting discussion amongst MPs last week. This was cause for a little optimism, as some of the language was quite damming and more in line with my discussion with my MP on Friday. Blunt and to the point.

The comment from Huhne just demonstrates that he is clueless. We are not even going to get to a 5% reduction by 2020 let alone 20% and he thinks we should aim for 30%. He is delusional, as are those who advise him and those who support him in his current position. The thing he should be worried about is the fact that China has announced the development of the molten salt Thorium reactor. This is an area where WE should be leading the way, and if we removed all subsidies from all other areas and commissioned a thorium reactor our energy worries would fade into history. But then expecting our political leaders to do the right thing is something we have all but given up on.

The only company I can find listed in the 350 under AE is ‘Hansen Transmissions International NV’ who aren’t doing very well, either. Can they be related to James..?

This is an interesting battle that is going on in Government, and demonstrates that the Lib Dems are clueless when it come to being practical. As I said in my post above it is money that is killing AGW

http://www.guardian.co.uk/politics/2011/feb/17/treasury-nick-clegg-green-agenda

Peter Geany, #12,

There isn’t much that you say that I’d disagree with, but I think there is also another way of looking at the ‘green revolution’ which is perfectly compatible with your views, but puts it in a historical context. All this reminds me of the 1970s.

In those days we had nationalised industries. They were very uncompetitive, but then they didn’t need to compete with anyone, so people thought that didn’t really matter. And they were also very inefficient, with appalling overmanning and low productivity, but that wasn’t supposed to matter either because the huge losses this caused were paid off by the government. Politicians never tired of telling the workers in the nationalised industries that they were the backbone of British industry, without acknowledging that British industry wasn’t really doing very well.

This system had little to recommend it other than creating a lot of jobs, but politicians could claim that unemployment was low so the economy must be in pretty good shape, and wasn’t it clever of them to manage things so well?

Then, in the 80’s, a government came along that was brave enough to say, “This doesn’t work really does it? Not only are nationalised industries failing to create any wealth for the nation, but also high taxation is required to keep them afloat. So instead of revenue being used to improve public services and fund enterprises that actually would create wealth, rather than consume it, it is being gobbled up by the low productivity and uncompetitive practices of the nationalised industries. We can so better than that.”

I seem to remember that the people who thought like this called themselves Conservatives or Tories.

During that decade the idea of denationalising industries swept the world, and most people thought that was a pretty good thing. For a while it was rather a rough ride, but eventually unemployment, national debt, inflation and interest rates all began to fall, ushering in an era of general prosperity. But then the banking crisis forced people to confront some unpleasant economic realities, like the massive debt that had powered supposed economic growth and funded unrestrained public services and infrastructure investment. Once again we faced the grey world of austerity that fiscal deficits inevitably inflict when reality catches up with eye-catching political initiatives and spin.

So far as I understand the present situation, our government intends to trade its way out of debt by means of something what it calls a ‘green revolution’, which is intended to ‘decarbonise the economy’. This seems to be all about producing energy in ways that are very inefficient expensive and totally uncompetitive, but create lots and lots of new jobs even if they are funded by subsidies from the government through increased taxes or less expenditure on public services.

We seem to have come full circle, but this time round the new unproductive and uncompetitive enterprises that are being funded by government are not nationalised industries. They remain in the hands of anyone who has been smart enough to join the gravy train, and who can blame them? Politicians and policy makers never tire of telling the new green businessmen that they are doing work of national importance that will save the planet. What is surprising is that the governing party, which has dreamed up this fiasco, call themselves Conservatives or Tories.

So what’s changed since pre-Thatcher times?

TonyN,

If you’d checked the figures before making your comparison of Green energy with the subprime banking collapse you’d have known that it just doesn’t make any sense. The numbers just don’t stack up.

You could have started by taking a look at £37 billion pa for defence.

http://www.mod.uk/DefenceInternet/AboutDefence/Organisation/KeyFactsAboutDefence/DefenceSpending.htm

and then a reported bill for UK taxpayers of £850 billion to bail out the UK banking system.

http://www.independent.co.uk/news/uk/politics/163850bn-official-cost-of-the-bank-bailout-1833830.html

The UK total budget for Green energy is less a £1 billion. From my reading of this article it looks like this is spread over several years. But even if it’s an annual figure its really just small change by comparison.

http://www.renewableenergyfocus.com/view/13358/uk-renewables-industry-takes-stock-of-spending-review/

I understand the arguments that taxpayers don’t like subsidising nationalised industries, but we have nationalised industries here in Australia that actually make a profit.

Correct me if I’m wrong, but both the USA and the UK seem to have opted for a system whereby the banking system is allowed to remain in private ownership, with their profits distributed to those private owners, when times are good. But when times are bad, the taxpayer picks up the tab to cover those losses.

So, yes, there are pros and cons from the taxpayers point of view with regards to privatised/nationalised industries, but haven’t both governments chosen all of the ‘cons’, and none of the ‘pros’ from both options?

PeterM

You seem to have completely missed TonyN’s point:

It’s not about comparing the absolute magnitude of the “green energy” debacle with that of the “bank meltdown”. The latter was an enormous disaster. The former is a short-sighted political policy, which will not achieve a “green revolution”, but simply waste large sums of taxpayer money, eventually leading to a future disaster.

To say it’s all OK because it’s not as bad as the bank collapse or will not cost as much as defense spending is illogical (and irrelevant), Peter.

A bad deal is a bad deal. And this one will get much worse as the lights go out and direct or indirect carbon taxes are levied in order to finance the debacle.

Max

Max,

I’m sure that TonyN can speak for himself, if he wants to!

However, I’d just make the point that if the UK government does want to try to “trade its way out of debt”, by any means, including partially or totally, an element of spending on energy supplies, then a figure of less than a £1 billion is just not going to anywhere near adequate.

This sort of program is just ‘greenwash’ designed to give the impression that a problem is being tackled.

PeterM

He already has (see #15).

In today’s world of inflated budgets and government spending, £1 billion does sound like “peanuts” (a mere pittance of £16 per man, woman and child), but government forecasts are invariably understated. It seems to me that the more pertinent point is that before one decides to “tackle” a “problem”, one must first establish that there is a “problem”.

On the NS thread I showed that the average EU inhabitant’s share of the proposed future carbon tax would be around $2,000 per man, woman and child annually (with the UK a bit higher than the average), so this is no longer “peanuts”.

From what I have read, it appears that the UK (unlike China) does not have a real energy policy, but is simply chasing windmills and green energy schemes because they sound “nice” and the “politically correct” thing to do.

I can see why UK residents, like TonyN or Peter Geany, could get frustrated by their government’s lack of direction (you and I are on the sidelines here, so really not directly impacted).

The US does not appear to be much better, but that’s another story.

Max

The title of the thread is “Will Alternative Energy be the next Subprime disaster?”

The obvious answer is “No it won’t” Because the sums of money involved would need to be multiplied by a thousand to be comparable.

Even allowing for some overspend, I doubt if even TonyB thinks this is even remotely possible.

Evidently the concerns expressed in the header post on this thread are shared in high places. The following link is to one of a number of media reports that have appeared in the last few weeks:

http://www.guardian.co.uk/politics/2011/feb/17/treasury-nick-clegg-green-agenda

In the aftermath of the banking crisis, there is good reason for shunning the kind of liabilities that the Green Investment Bank would acquire. To do otherwise would indicate that the Treasury had learned nothing from recent history.

On the other hand, it is difficult to see how the government’s grandiose plans for a green revolutions can be financed otherwise. So we have a rather interesting situation.

More problems for the alarmist AGW world. http://www.climatesciencewatch.org/2011/02/19/house-votes-244-179-to-kill-u-s-funding-of-ipcc/

The next thing we will see is a lot of out pouring from liberal elite in Europe about how crass and greedy the US is. They will indulge in their usual we are so superior and know best rhetoric.

I’m not sure that the US cutting funding for climate research would necessarily be such a bad thing.

Firstly, and contrary to what you hear from climate deniers, the scientific community isn’t calling for ever greater amounts of money to be spent researching the AGW problem. That way politicians would have an excuse for doing nothing – they’ll always be waiting for the results of the increased research effort!

Any new money should go to research on how CO2 can be directly reduced, and that requires groups of engineers and scientists with completely different skills and backgrounds. So, if you think about it, (and I know that may be difficult for some of you) the ‘gravy train’ objection just doesn’t make sense.

Secondly, the US Republican politicians who are promoting the idea of cutting scientific spending can kiss goodbye to any pretence of being scientific sceptics. A true sceptic position would be that more evidence is needed not less. They may as well just say they just don’t want to know if AGW is turning out to be a real problem. They’ve decided it isn’t and that it must be against the US constitution, or whatever, to think otherwise. Their status as deniers will be well and truly confirmed.

PeterM

You have given a rather convoluted analysis of the reasons for and results of the US Congress decision to cut IPCC funding.

I’d say it has much more to do with the lack of credibility of that body following all the revelations of corruption and bogus scientific data promulgated by this group.

Not too many people take IPCC seriously today, so it is reasonable to conclude that very few people are interested in funding another 1000+ page volume of exaggerations and speculations cloaked in the mantle of “climate science”. (The last one was bad enough.)

Climate science needs to shift away from the IPCC approach of “proving that AGW represents a serious potential threat” to finding out more about natural climate forcing (still a major “unknown” today) and clearing up the many huge uncertainties relating to the AGW premise. Is cloud formation tied to long-term ocean current oscillations, such as PDO (as correlations by Spencer have shown)? How is ENSO involved? What drives these and other oscillations? What has caused the observed multi-decadal temperature cycles since the modern record started in 1850? What caused even longer cycles, such as the LIA and MWP (rather than “how can we make it appear that these cycles never occurred, so we can claim unusual 20th century warming”)?

If we really want to understand how our climate functions, we need to work on answering these questions, rather than simply putting together half-baked projections and bogus “hockey sticks” to support the IPCC sales pitch.

That’s why IPCC (unlike climate science, itself) has become irrelevant and redundant.

Max

PeterM and PeterG

The US Congress decision to cut IPCC funding is not directly related to the topic of this thread, which (as I understand it) has more to do with UK green energy policy and its likely financial impact, specifically the conflict between the Treasury and the Ministry of Environment on how to handle “green investments”.

The general lack of credibility of the IPCC among US Congressmen has not yet moved to the British Parliament (or the Department of Energy and Climate Change), but (maybe) this is only a matter of time (Lord Monckton is certainly doing his best to accelerate this).

But maybe we should move our discussion on this to the NS thread (before TonyN does).

Max